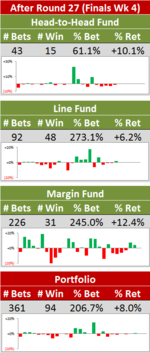

Historical MAFL Fund Performance

The first couple of years of MAFL were, we now know, all too easy, the Recommended Portfolio returning 12.2% and 9.2% in 2006 and 2007 respectively (actually a good deal more in 2006 after the Special Stupidity Dividend - for details download the 2006 Newsletter #19.1 from the "MAFL - The Early Years" tab).

In 2008 MAFL's Recommended Portfolio recorded its first loss, and an impressive one it was at that, with the final share price for the Portfolio ending its apparent freefall at just over 72c, despite rebounding by just over 6c courtesy of the Hawks' Grand Final victory. Mercifully, this remains the worst single-season performance of any MAFL Recommended Portfolio.

In 2008 MAFL's Recommended Portfolio recorded its first loss, and an impressive one it was at that, with the final share price for the Portfolio ending its apparent freefall at just over 72c, despite rebounding by just over 6c courtesy of the Hawks' Grand Final victory. Mercifully, this remains the worst single-season performance of any MAFL Recommended Portfolio.

2009 saw a return to profitability, albeit only just, as the Recommended Portfolio finished at $1.01 after dropping almost 12c in the last two rounds of the season. Never was an off-season so welcomed.

A fitful 2010 season for the Recommended Portfolio saw it finish at a tick under 95c, never fully recovering from a horrible Round 8 in which over 11c was carved out of its price.

2011 heralded the entry of the Gold Coast into the competition, and the difficulties in rating this new team, coping with byes for the first time in MAFL history, coupled with an ill-considered decision to commence wagering from Round 1 of the season, resulted in a loss of over 25c for the Recommended Portfolio. The loss was mitigated - a tad - by the Line Fund's profitability, making it two successive years of profitable line betting in MAFL and offering some hope for this form of betting in the season's ahead.

Or so I thought then. 2012 provided the third successive loss for Investors, this time due mainly to a highly-unprofitable foray into margin betting, which resulted in the lowest ever end-of-season price for a single Fund as the dully-named and direly-performing Margin Fund limped out of September valued at just 12.5c.

Mercifully, MAFL's poor run of form reversed in 2013 with, for the first time ever since the term "Recommended Portfolio" meant anything, every Fund in that Portfolio making a profit. Much of the profit, especially that of the Line Fund, was due to the newly-introduced policy of "variable cap" wagering in which Funds were permitted to wager smaller or greater amounts at different points in the season on the basis of the Fund's historical wagering performance at that time of the season.

So, had you been in on MAFL from the beginning, invested in the Recommended Portfolio at the start of every season and withdrawn all your funds at the end of each season, every $1 you'd invested would today be worth about 96c including the Special Stupidity Dividend (SSD). If, instead, you'd reinvested the previous season's proceeds every season, then your $1 would be worth only about 61c, again including the SSD. Compounding really isn't your friend when you're multiplying by numbers with a zero in front of the decimal point.

If there's a lesson in all of this - and, in truth, there are several, a number of which I'm consciously in denial about - I'd argue that it's in that (1.8%) figure at the foot of the second column. It represents the proportion of every $1 that we've bet that's not been returned to us. (This is different from the proportion of total funds invested that have been returned to Investors because every dollar in MAFL Funds has been wagered about 3.5 times during an average season.) In other words, for every $1 we've bet, 98.2c has been recouped.

Though it's difficult to come up with a definitive figure, a reasonable and conservative estimate of the "vig" Investors have faced, on average, across the seasons and across all wagers would be about 5%. This means that, had we bet at random, we should have expected to win back only 95c in every dollar we invested. In this sense Investors have lost only about 35% as much as they notionally should have and the statistical models have demonstrably performed better than random wagering. Small comfort indeed.

The lesson then? It's this: in gambling against the house it's entirely possible to do better than you should - to exhibit something approaching skill and ability - and still walk away with a loss.